Over the past decade, PortfolioMetrix has pioneered a paradigm shift away from the traditional "art and science" of investing to a more rigorous, risk-calibrated approach. While this delivers discipline and consistency, it cannot address one crucial factor: behaviour. Markets are not governed by immutable laws but by the impulses of human psychology. This is where advisers exhibit great value.

Advisers are not just portfolio constructors; they are behavioural coaches. No matter how meticulously one sets assumptions around savings, retirement age or risk appetite, the plan will disintegrate if emotions rampage during market stress. The most costly mistakes tend to be the simplest: panic selling at market lows, chasing returns at peaks or abandoning a long-term plan when the outlook turns bleak.

Nassim Taleb's concepts of fragility, robustness and antifragility provide a useful framework for thinking about portfolio characteristics. A fragile portfolio breaks under pressure, whereas antifragile portfolios, typical of certain hedge funds, thrive on chaos. At PortfolioMetrix, we do not seek antifragility, instead we build robust portfolios—designed to withstand stress and deliver steady performance over time. Success, in this context, is not defined by spectacular wins but rather by avoiding debilitating losses.

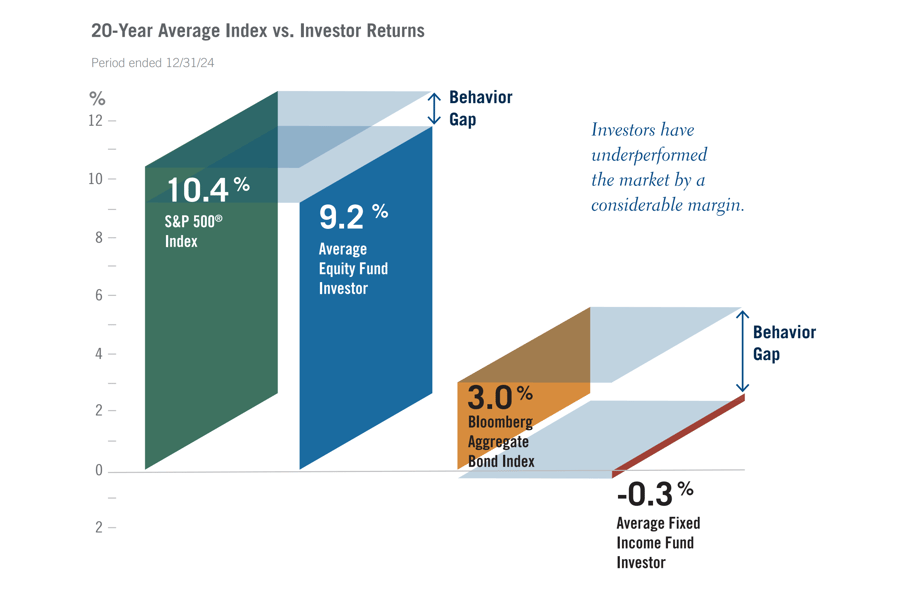

The numbers illustrate the issue plainly. Over the past 20 years, equity investors earned an average annual return of 9.2%, while the S&P 500 delivered 10.4%, resulting in a persistent behaviour gap.

Figure 1: Virtus Investment Partners (Minds Over Markets), DALBAR (2025 QAIB Report)

Meanwhile, the "Guess Right Ratio," which measures the accuracy of investors' market predictions, indicates that since 2015, investors have been unable to surpass the odds of flipping a coin (50%).

Figure 2: DALBAR (2023 QAIB Report)

Figure 2: DALBAR (2023 QAIB Report)

Unsurprisingly under stress, behaviour worsens. In 2020, the largest equity outflows occurred just before a double-digit rally in November (Figure 3). And in 2024, investors sold equity funds continuously throughout a strong market rally, with the most significant outflows happening just before major gains. Exiting at these moments translates to locking in losses and missing the recovery—compounding the cost of emotional decisions.

Figure 3: DALBAR (2021 QAIB Report)

Figure 3: DALBAR (2021 QAIB Report)

Modern markets exacerbate the problem. Real-time data and headlines provoke instant reactions. The 2024 market recovery happened so quickly that many investors missed it entirely. The lesson is clear: the more reactive an investor becomes, the more they sabotage their outcomes.

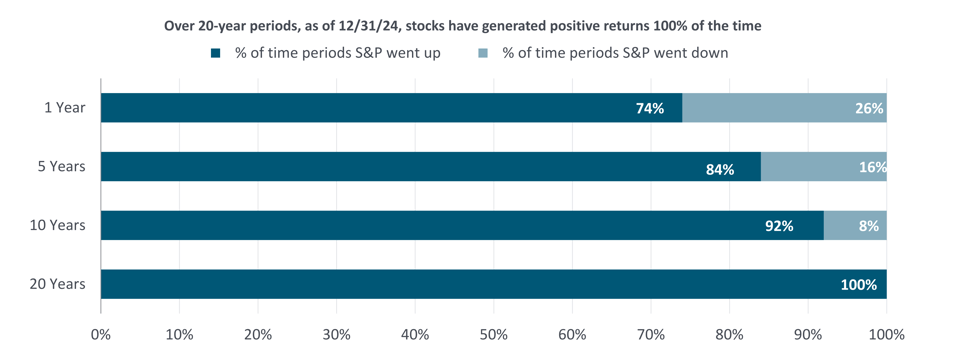

Figure 4: MFS (Principles of Long-Term Investing Resilience)

The solution lies not in better market timing, but in superior portfolio design and guidance. Diversification is often discussed in the context of optimising risk and return, but it also serves as a behavioural guardrail by smoothing short-term volatility. This combined with advisers` ability to enforce pause, perspective and process creates the discipline necessary for wealth creation.

A consistent portfolio experience cultivates long-term commitment—because investing, at its core, is an exercise in patience. Just as roots establish themselves across seasons, not days, portfolios compound across cycles, not quarters. Dig up your investments with every market tremor, and you guarantee stunted growth. Leave them anchored, and they weather volatility naturally.

Sources: DALBAR QAIB Report [2021,2022,2023,2024,2025].